Space not available

Merci de sélectionner un format d’annonce

The file format is not recognized

Click here to download an ad

Click here to download an ad

Here you can drag and drop or upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Position

Reserved space

Announcement transmitted

Reference

– A liberal banking system in line with international standards

The DRC's banking sector remains dynamic, with total assets increasing by approximately 401,300,000 in 2021. Banks and microfinance institutions alike demonstrated a strong and sustained recovery in activity. By the end of 2021, the banking sector had collected over USD 11 billion in deposits.

Space not available

Merci de sélectionner un format d’annonce

The file format is not recognized

Click here to download an ad

Click here to download an ad

Here you can drag and drop or upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Position

Reserved space

Announcement transmitted

Reference

The Central Bank of Congo has reacted swiftly to the financial impacts of the Covid-19 health crisis, announcing a series of measures aimed at mitigating the negative effects of the epidemic on the Congolese economy. These measures, in line with those taken by central banks, governments, and international institutions, primarily pursue a dual objective:

The Central Bank of Congo has reacted swiftly to the financial impacts of the Covid-19 health crisis, announcing a series of measures aimed at mitigating the negative effects of the epidemic on the Congolese economy. These measures, in line with those taken by central banks, governments, and international institutions, primarily pursue a dual objective:

Limit the deterioration of asset quality by granting, for example, payment deferrals to companies affected by the effects of the pandemic without interest charges, fees, or late payment penalties in order to allow borrowers to absorb the economic impact of the health crisis and adapt; ;

Supporting bank liquidity by giving them, for example, access to low-cost financing so they can meet the loan demands of borrowers affected by the pandemic. The Central Bank of Congo, which had reduced its reference interest rate by 150 basis points to 7.50%, established a special refinancing window for transactions with a duration of between 3 and 24 months at a relatively low cost and lowered the required reserve ratio from 2% to 0% on demand deposits in Congolese francs.

By postponing the strictest capital requirements, the Central Bank has enabled banks to mitigate the deterioration in asset quality by giving them greater flexibility in managing borrowers facing temporary liquidity problems.

Space not available

Merci de sélectionner un format d’annonce

The file format is not recognized

Click here to download an ad

Click here to download an ad

Here you can drag and drop or upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Position

Reserved space

Announcement transmitted

Reference

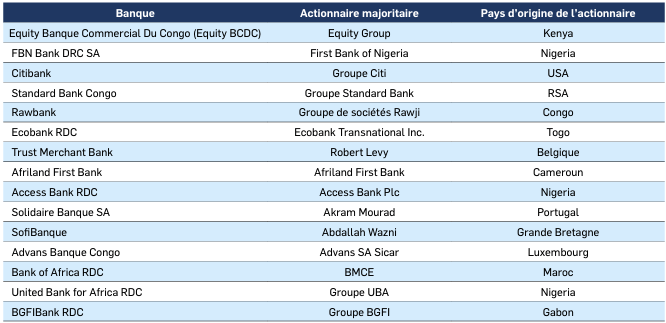

The current banking system in the DRC is dominated by foreign banks, which can generate several long-term economic benefits. Indeed, foreign banks are known to be major catalysts for foreign investment inflows. Foreign banks with investment banking arms can even provide advice to investors. However, the largest bank in terms of assets is a local bank, Rawbank.

The Congolese banking system has long lagged behind in terms of legal framework and banking supervision. In order to improve the country's central bank, the government has decided to implement the IMF's restructuring recommendations.

The entry of foreign banks into an economy is expected to impact the quality of financial services at various levels. The effect of competition will incentivize local banks to reduce costs and expedite banking operations.

The Congolese banking system should see the development of the network of banking agents and other financial inclusion innovations as a means of access to the unbanked population and other innovations to unlock the country's great potential.

Foreign banks are associated with the efficiency of the banking system in emerging economies. In the DRC, the high percentage of foreign banks should therefore be reflected in the transfer of technology and skills.

In 2022, the banking sector remained generally stable with a positive overall solvency ratio. The overall solvency ratio stood at approximately 12.51 TP3T, compared to the minimum required threshold of 101 TP3T. Furthermore, the banking sector remained quite dynamic, particularly as evidenced by the approximately 401 TP3T increase in total assets in 2021.

Law No. 22/069 of December 27, 2022, concerning the activity and supervision of credit institutions, includes ten innovations. It will enter into force six months after its publication in the Official Gazette.

The DRC wishes to access regional and international financial markets, its current situation proving to be an opportunity to achieve integration.

Space not available

Merci de sélectionner un format d’annonce

The file format is not recognized

Click here to download an ad

Click here to download an ad

Here you can drag and drop or upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Position

Reserved space

Announcement transmitted

Reference